There’s no denying that Elvis Presley was one of the most influential and successful musicians of all time.

You may not realize it, but he was also one of the most successful and influential marketing brands of all time.

You see, when Elvis’s career was first taking off, his manager, Colonel Tom Parker, thought this young musician was just a fad that would soon flame out. He set out to make as much money as possible off the young rock-and-roller in as short a time as possible.

To that end, the former carnival promoter signed a $40,000 deal with a movie merchandiser to sell Elvis-themed products. Soon perfume, lipstick, bubble gum cards, scarves, necklaces, and more — all promoting Elvis — flooded the market. And Colonel Parker took a whopping 50% cut from the proceeds.

In fact, Colonel Parker was such a savvy marketer that he even figured out a way to make money off the people who didn’t like Elvis. He sold buttons with slogans like “I hate Elvis” and “Elvis is a jerk,” and turned a handsome profit from them.

It’s pretty easy to view the story of Elvis and Colonel Parker as a cautionary tale for young musicians, who should be wary of managers seeking a huge cut of their earnings.

But it also holds a lesson for B2B pricing practitioners.

You see, Elvis and his manager were experts at segmenting the available market and extracting the maximum that each segment was willing to pay. If you loved Elvis and were willing to fork over a week’s pay for a new Elvis necklace, they would gladly sell it to you. If on the other hand, you hated Elvis and were only willing to pay a dime for a button advertising your hatred, they would also gladly sell it to you. They managed to get two very different segments — Elvis lovers and Elvis haters — to hand over as much money as they were willing to part with.

In B2B, pricing segmentation looks a little different, of course. Hopefully you don’t have any potential customers who hate your company. But you almost definitely have different segments who are willing to pay a different amount for your products and services.

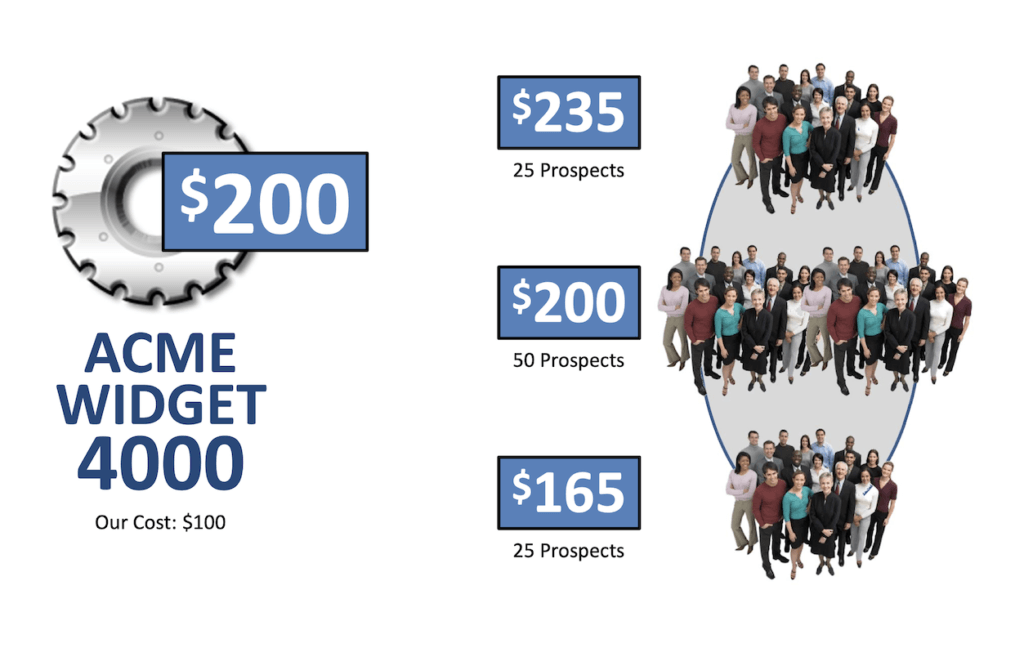

For example, imagine you work for Acme Widget company, which sells the Acme Widget 4000. A small group of prospects, let’s say 25, are willing to pay $235 for this amazing invention.

But you probably also have other segments that want the Acme Widget 4000 but have less to spend. For the sake of our example, let’s say you have 50 prospects willing to pay $200 and 25 willing to pay $165. Now you have some math to do to figure out the optimal price:

Price at $235

$235 x 25 prospects = $5,875 revenue – ($100 part cost x 25 parts) = $3,375 profit

Price at $200

$200 x 75 prospects = $15,000 revenue – ($100 part cost x 75 parts) = $7,500 profit

Price at $165

$165 x 100 prospects = $16,500 revenue – ($100 part cost x 100 parts) = $6,500 profit

At first glance, it seems like pricing your widget at $200 would yield the best revenue and profit. But what if you could give each segment a different price tailored to their willingness to pay? The math would look like this:

Price by segment

$235 x 25 prospects = $5,875 revenue

$200 x 50 prospects = $10,000 revenue

$165 x 25 prospects = $4,125 revenue

$5,875 + $10,000 + $4,125 = $20,000 total revenue – ($100 part cost x 100 parts) = $10,000 profit

With segmented pricing, you would bring in a full 33% more than the best pricing scenario where everyone paid the same amount. And when the numbers get bigger, the totals become even more striking.

We elaborate on these ideas in a trio of resources:

- The Fundamentals of Price Segmentation

- Getting the Most Out of Price Segmentation

- How to Explain Price Segmentation to Others

Hopefully, after checking out these webinars you can’t help falling in love with pricing segmentation and you’ll keep segmentation always on your mind.