On a business trip a few years ago, I sat next to a top executive of a leading high-tech manufacturer. It was mid-morning and we’d both had way too much coffee to just sit quietly. So, we struck up a conversation about our respective businesses.

When this executive learned that I was involved in pricing, he offered up this little gem, “You should study my company. Our pricing capabilities are world class!” When I asked how he knew that, he very confidently replied, “We’re the market share leader in our category and our margins are consistently 3 to 4 points higher than everyone else’s.”

Ah. I see. Time to change the subject. 🙂

I know…I shouldn’t be so snarky. After all, a lot of people think that comparative marginal rates are a good gauge of pricing capability. It’s really easy to think that if you’re selling more, at higher margins, then surely that must mean your pricing capabilities are superior. Right? Or at least they can’t be inferior. Right?

Ummmmm…no…sorry…not right.

You could be selling more than everyone else…and at higher margins….because your product designs are superior. Or maybe your distribution network is much more extensive. Or maybe your advertising is a lot more compelling. Or maybe you were a first-mover in your category. On and on, there are literally hundreds of things that can drive comparatively higher margins and sales.

In fact, you can have comparatively higher margins and sales while still leaving a ton of money on the table due to lame or nonexistent pricing capabilities!

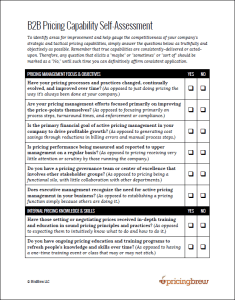

That’s why we’re big fans of capability assessments that focus on the processes and practices that are being utilized, rather than the output. The concept behind this type of assessment is really straightforward:

- If you’re doing the right things in the right ways—i.e. your processes and practices are good—the odds are really high that your work-product is also going to be good.

- On the other hand, if you’re not doing the right things in the right ways, your work-product is most likely subpar, too—no matter what your comparative margins may be.

With this type of an assessment, you can get a really good read as to how your pricing capabilities stack up and where they might be lacking by just answering some simple questions about what you do and how you do it.

Hence, the need to change the subject on that flight I referenced earlier.

You see, I just knew that if I kept asking questions, I’d end-up informing that gentleman that his company’s pricing capabilities were nowhere near world class and that those 3-4% higher margins were, without a doubt, leaving a pile of money on the table.

Of course, I wouldn’t have to do that…but I know myself well enough to know that I just couldn’t help it.

Assessing Your Pricing Capabilities

The B2B Pricing Capability Self-Assessment

Powerhouse Pricing Teams

In B2B, dedicated pricing teams are still a relatively new development. And as such, there are no long-standing rules for how everything should work. In this on-demand webinar, explore the common traits, characteristics, and behaviors of successful pricing teams that have been around longer than most.