There’s an old saying about what can happen when you “assume” too much. I won’t repeat it here…you can look it up on the interwebs if you’re unfamiliar…but let’s just stipulate that assumptions are very often wrong and can lead to inaccurate conclusions and less-than-ideal outcomes.

I was reminded of this truth in a recent conversation with a Senior Director who was debating whether or not to secure a group subscription for his team. You see, this Director was on the fence about subscribing because he assumed that they were a leading team already and therefore wouldn’t have much to gain or learn from a publication such as ours.

Why did he assume they were already a leading team? Because their team was relatively large and had been operating inside a leading company for nearly two decades.

Now, I can’t fault this person too much for assuming that this is what constitutes or defines a “leading” team. After all, these particular assumptions are actually fairly common and broadly held. That said, these assumptions just don’t stand up under closer scrutiny…or match what we’ve observed in the marketplace.

For example, just because the parent company is a leader doesn’t mean that all the functional groups within that company are also leaders among their functional-group peers. In fact, we’ve run across many companies that excel at designing and manufacturing particular products, while at the same time having only the most rudimentary capabilities in other areas of their business.

Are they leaving money on the table? Of course! But the reality is that tremendous strength in one area can hide huge deficiencies in a lot of other areas…and for a very long time.

So what about team size? Or tenure? On their own, these things are just not that indicative of leadership in functional capability. While a big team might be able to do more, it might also be wildly inefficient and difficult to manage. And while a long-established team might have learned more through trial and error, they might also become more entrenched in the status quo and resistant to change.

From what we’ve seen, there are lots of big teams…that have been around for a very long time…in some really high-profile companies…that are actually behind the curve when it comes to functional capabilities. On the other hand, we’ve also seen that there are many relatively small and newer teams…in companies you’ve not heard of yet…that are doing amazingly things and blazing new trails.

The point is that when we talk about “leading teams,” we’re not necessarily talking about the oldest teams, the biggest teams, or even teams within the most well-known companies. Of course, some of the teams we reference do actually possess many or all of these characteristics. But to be clear, these characteristics are not the reasons we look to them as leaders.

From our perspective, leading teams are defined by what they are doing…their actions and results…and not by their outward appearances.

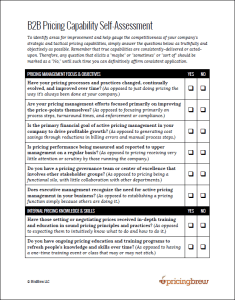

So, if appearances aren’t reliable, how do you know whether you’re a leader or a laggard? If you’re already a subscriber, you can certainly use our capability assessment to better understand how your function stacks up.

But if you’re not yet a subscriber, I would suggest perusing our catalog. The range of topics we cover and content we provide should give you a pretty good idea as to what the leading teams are doing.

When you look at our catalog, if it all seems like “old hat” and stuff you already do all day, every day, then you might be a leading team. But if a lot of it is new and different and doesn’t seem to line up with your day-to-day….well…there’s your answer.

Assessing Your Pricing Capabilities

The B2B Pricing Capability Self-Assessment

Powerhouse Pricing Teams

In B2B, dedicated pricing teams are still a relatively new development. And as such, there are no long-standing rules for how everything should work. In this on-demand webinar, explore the common traits, characteristics, and behaviors of successful pricing teams that have been around longer than most.