The Five Guys hamburger chain likes to boast that there are 250,000 different items you can order from their menu. If you had never eaten there before and you read a claim like that, you might think that their menu is at least 100 pages long.

Nope.

The entire Five Guys menu fits on a pretty small piece of cardboard on the wall behind the counter. And if you print the menu out on a piece of paper, it doesn’t even take up a whole page.

How is it possible to fit 250,000 different items on less than a page?

The menu options are pretty basic, but five guys offers a long list of free toppings. You can customize your burger or sandwich or hot dog however you like it. And they have freestyle Coke machines that allow you to mix or match beverage flavors however you like as well. The actual menu looks like this:

So now that you’re hungry, why did we spend all this time talking about a burger menu?

We talk a lot about pricing segmentation, and we tell people that the more granular your segments are, the more effective your segmentation will be.

But if you start thinking about having hundreds or thousands of different segments, it’s pretty easy to feel overwhelmed. How could you possibly keep track of so many different segments?

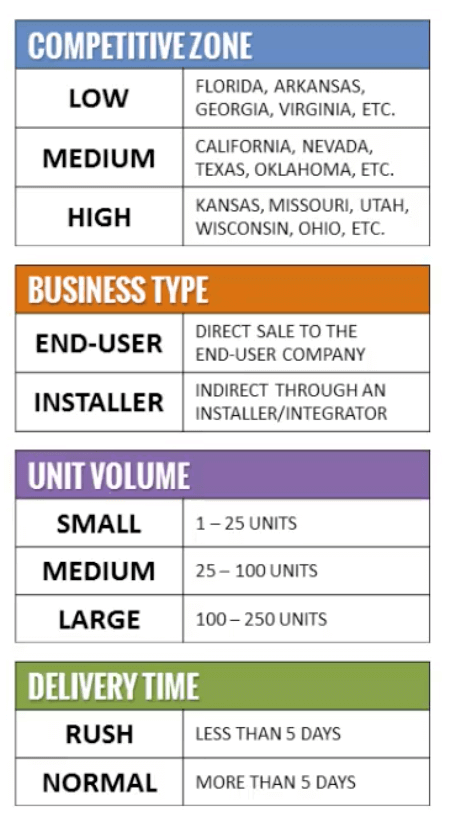

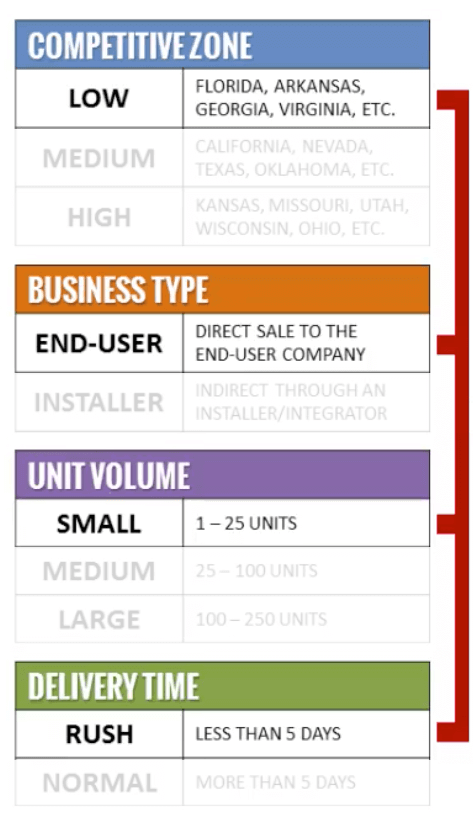

It’s a lot easier if you think about organizing your segments more like the way that Five Guys organizes its menu. Instead of thousands of different individual segments, think of your segments as different possible combinations of options. The graphics below illustrate this pretty well:

In the same way that the Five Guys cooks have no trouble keeping track of an order for a cheeseburger with lettuce, tomato, and hot sauce, you might find it easy to keep track of a segment that is a low competitive zone, end-user type business, small unit volume, with rush delivery. By organizing your segments in this way, you can come up with lots and lots of different combinations that you can price appropriately.

If you haven’t done this sort of segmentation before, you’ll need to start by identifying the different dimensions in your orders. Maybe some of your dimensions are similar to the ones listed above, or maybe you need different factors like vertical market, customer business size, or country. The dimensions are going to be unique to your business, and remember, they need to be things that have an impact on the price the customer is willing to pay, not just attributes that make categorizing orders easy.

Once you have identified those different dimensions, you can create the various segment combos that exist and even backcast them on past orders to see the variability of prices. From there, you can start making directive and corrective findings for the future.

To learn more about this kind of segmentation, watch the webinars on The Fundamentals of Effective Pricing Analysis and The Fundamentals of Price Segmentation. They can help you get started with what is really one of the most valuable weapons in your pricing arsenal.

Segmentation models — even with thousands of possible segments — don’t need to be overwhelming. These webinars can help you wrap your head around the key concepts.

And now, if you’ll excuse me, I have a hankering for a bacon cheeseburger with grilled mushrooms and jalapeno peppers.