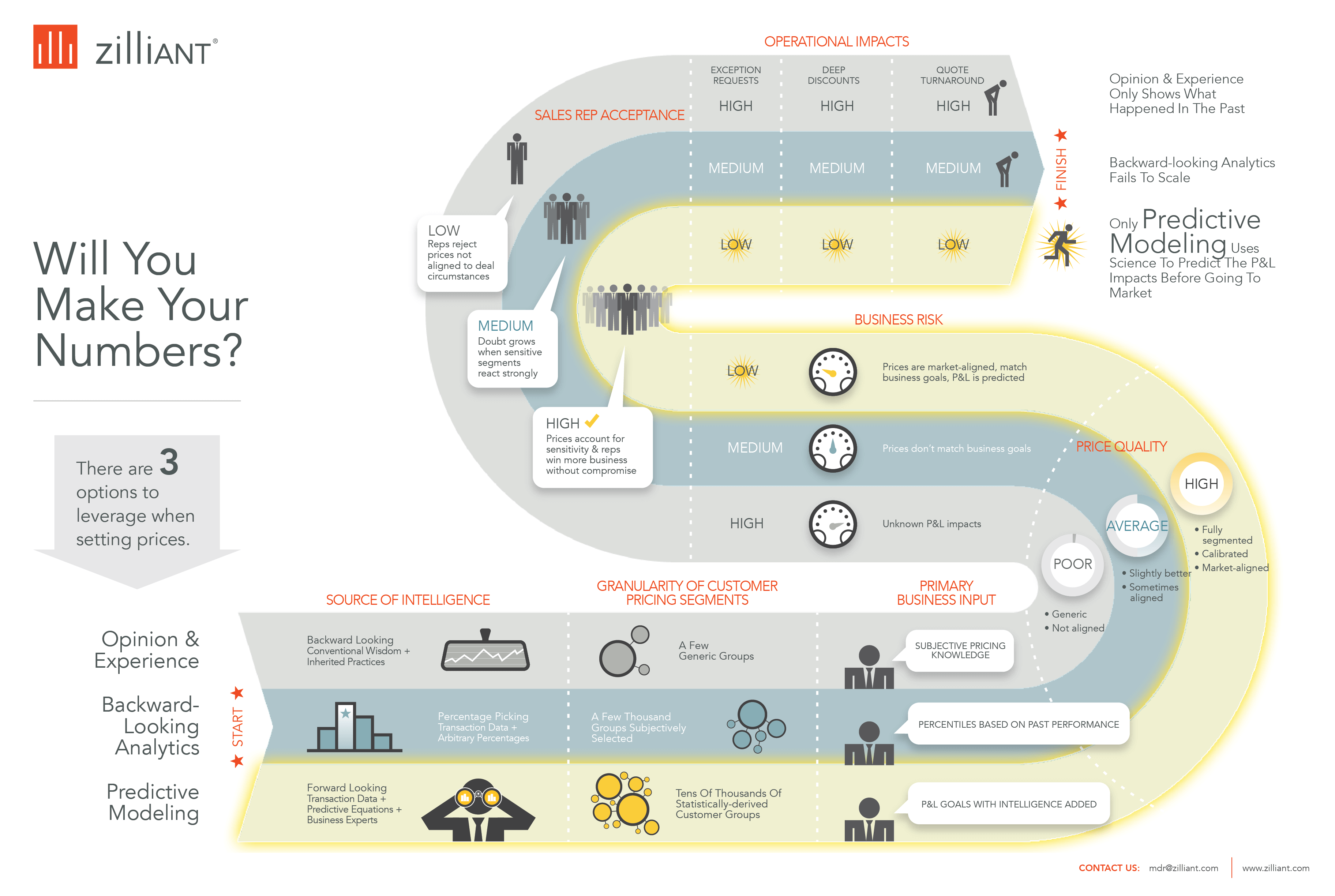

It’s an all too common reality for many B2B companies: the use of overly general segmentation to set prices because of the belief that it’s simply too complex to be more granular. In fact, I recently heard the following comment: “(Pricing) segmentation is too expensive and too complicated for most managers to deal with. Apart from that, it doesn’t work anyway.”

Pricing segmentation is far from being dead; in fact precise segmentation is the lifeblood of market-aligned pricing. It’s only through effective, granular price segmentation that it’s possible to understand and extract the fair value of your offering from each customer. Two things often trip up the manager who is trying to apply effective price segments: declared segments and segmentation that fails to scale.

“Declared” Segments

The first mistake is the use of “declared” segments rather than those which are statistically derived. By “declared,” I mean that a group of people sit in a room and express opinions about which factors influence price in the market. The problem with this approach is that it fails to discover important factors that aren’t top-of-mind, and it can lead companies to perpetuate myths about which factors are supposed to matter, but really don’t. I’m open to any hypothesis about factors that influence price, but before any conclusions are drawn I insist on seeing the regression analysis that proves which factors matter, and quantifies how much they matter. Why guess when you can know?

Segmentation that Fails to Scale

The second problem is that once you have identified the six to 10 most important pricing factors — and all segment combinations which can arise from them — you realize that you will have thousands (or tens-of-thousands) of price segments to consider, whereas, before this exercise, you may have had only dozens or a few hundred. Your sophisticated spreadsheet that manages segment-level prices suddenly looks wimpy when compared to this giant, thousand-headed monster you must now slay. For this reason, you must abandon the spreadsheet and move to commercial pricing tools which operate at this scale with ease.

If someone says that “segmentation doesn’t work anyway,” it’s likely that the person has stumbled on one of these two problems. The reality is that overly general segments are a setup for poor pricing outcomes. Without accurate price segmentation driving the optimal price guidance for each selling circumstance, inevitably, some good deals will be driven away while others leave money on the table. A better way is to leverage available solutions that scientifically identify thousands of distinct price segments so you can surgically set the right price for each selling circumstance.

Learn more about how effective price segmentation can improve price quality from this infographic: